How’s the Market? Q3 2025 Review of Seattle Area Real Estate

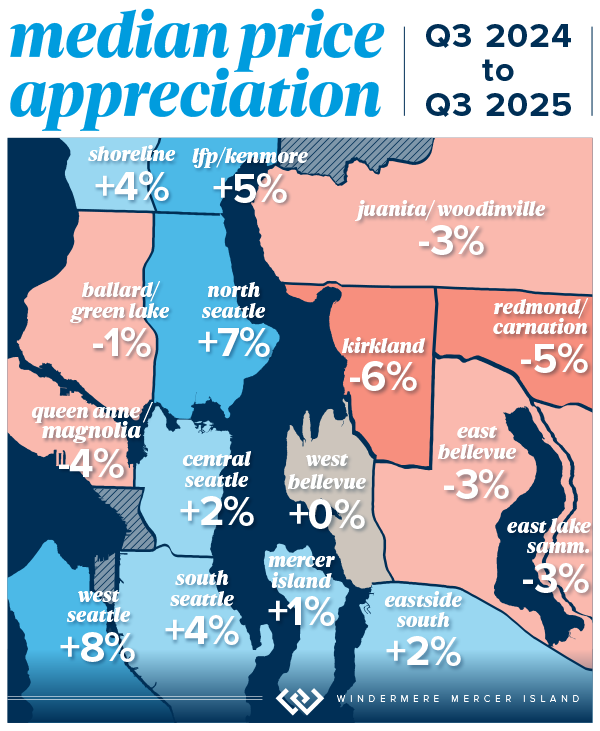

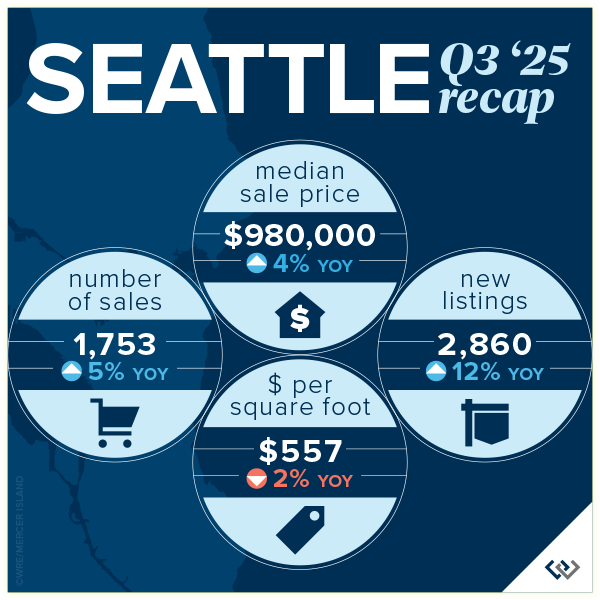

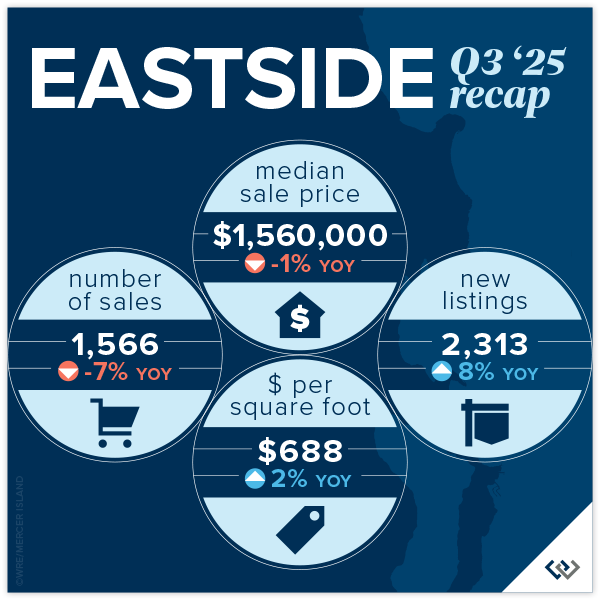

Summer brought balance to the Greater Seattle housing market, with most homes taking longer to sell and often going for below list price. The most desirable homes are still selling above list price—but it’s safe to say that the days of multiple offer frenzies are behind us for the present. Median sales prices held fairly steady with a modest 4% year-over-year gain in Seattle and slight 1% dip on the Eastside.

Our advice to home sellers is genuine and has carried over from Q2: well-priced, well-prepared homes still move quickly, but overall, the frenzy of spring has eased into a steadier rhythm. The first 10 days matter more than ever. For buyers, with more listings than last year and slower sales coupled with lower interest rates, you have a selective advantage and opportunity to find a great property. If single family homes are starting to feel out of reach, don’t overlook the townhome and condo market. It’s been a fantastic option for buyers looking for value and convenience!

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

Seattle went from a hot spring to a balanced summer! And boy, did Seattle show off when it comes to growth in the numbers. While the summer market shifted to a steadier pace, the city’s median home price landed at $980,000, 4% above last year but slightly below Q2’s peak. Homes took longer to sell, and bidding wars eased as buyers gained more breathing room much like the Eastside. Still, well-priced listings in popular neighborhoods like West Seattle and North Seattle continued to move quickly and often close to asking price.

Inventory remains healthy, giving buyers options and sellers the chance to stand out through pricing and presentation. Urban cores such as Capitol Hill (+16%) and North Seattle (+18%) held firm, while areas like Ballard and Queen Anne saw small seasonal dips. 48% of homes sold within the first 10 days at their listing price or above, 27% of which experienced multiple offers. Overall, Seattle’s housing market remains strong—just more measured and thoughtful as we head into fall.

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

After a bustling spring market, summer brought a welcome dose of balance across the Eastside. Remember, last quarter, 66% of homes sold at or above their listing price in the first 10 days. This quarter, under half the properties (43%) had the same results. Median home prices held steady at $1,560,000, just 1% below last year, while the pace of sales slowed as buyers gained breathing room. With fewer bidding wars and longer market times, many buyers had the opportunity to compare options and negotiate.

Rising inventory and selective buyers mean strategy matters more than ever. Sellers who price accurately and make a strong first impression are still achieving great results, especially in desirable neighborhoods like West Bellevue and Kirkland. Buyers, meanwhile, are finding opportunities in Redmond (+ 8%), and East Bellevue (+ 26%) as prices soften slightly. The Eastside market remains healthy, just more measured and thoughtful as we head into fall. There is a luxury resilience as well—West Bellevue and Mercer Island held firm proving that well positioned homes still move if priced right.

Click here for the full report and neighborhood-by-neighborhood statistics!

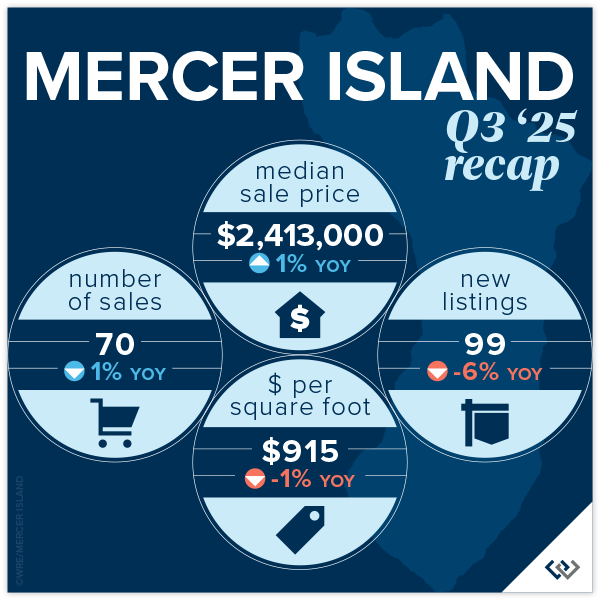

MERCER ISLAND

After a lively first half of 2025, Mercer Island’s market eased into a steadier rhythm this summer. The median sale price held at $2,413,000, which was nearly identical to last year (but down from last quarter’s $2.5M median price) with 70 total sales vs. 72. Fewer homes sold in bidding wars or within the first 10 days, but well-priced, move-in-ready listings continued to attract strong attention. The North End and East Seattle neighborhoods led in pricing, with select properties exceeding $5M, while most of the Island maintained stable values.

The shift from spring’s fast pace to summer’s calmer tempo signals a more thoughtful market on Mercer Island. Sellers can expect longer market times but solid results when listings are priced strategically and presented beautifully. Buyers, meanwhile, will find a bit more room to negotiate and a wider selection across price points (60% of the homes that sold on the island sold below their original listing price) particularly appealing as single-family inventory remains limited region wide. Mercer Island continues to demonstrate both resilience and lasting desirability heading into fall.

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

After a busy spring, Seattle area condos entered a steadier phase this summer. Median prices eased slightly to $600,000 region-wide, while average price per square foot dipped 3%. Fewer bidding wars and longer market times gave buyers more room to negotiate, especially in core city neighborhoods. Even so, affordable communities like Ballard (+52%!) and South Seattle (+47%) remained bright spots, showing that well-priced listings continue to draw attention. Specifically, of 157 condo sales in Ballard/Greenlake, 60 of those sales were new construction, a hot segment of the market right now.

On the Eastside, condos held their value and continued to offer a more attainable path to homeownership than single-family homes. Woodinville and Mercer Island posted notable price gains, while overall competition moderated from spring levels. With condos under $700K still in good supply, there’s a strong opportunity for buyers seeking value and location without sacrificing quality.

Our advice to condo sellers: price realistically, present well and have patience with the longer market times, especially if you’re selling a downtown luxury product. For buyers, this is the best condo buying environment we’ve seen in over a year. With more listings than last year and slower sales coupled with lower interest rates, you have a selective advantage and opportunity to find a great property.

Check out area-by-area details in the full condo report.

WATERFRONT

Seattle waterfront picked up this summer with 10 sales (as opposed to just 4 in the spring). Eastside and Lake Sammamish also stayed busy with 11 and 9 waterfront sales respectively. Only 2 homes sold above their list prices—the vast majority sold below list, with only a few selling right at the asking price.

West Bellevue saw the highest sale, with a nearly 9,000 sq. ft., shy half-acre estate on 80 feet of Meydenbauer Bay waterfront fetching over $20 million. The most affordable home was a cozy bungalow on 100 feet of Lake Sammamish waterfront that went for $1.5 million.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

View the full waterfront report

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2025, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Mercer Island cover photo courtesy of The Sirianni Group; by Andrew Webb, Clarity Northwest Photography. Condo cover photo courtesy of Luke Bartlett, by Matthew Gallant, Clarity Northwest Photography.

How to Price Your Home for Sale

The right listing price is absolutely critical to a successful home sale. Price too high and you will miss your shot to generate interest with a sense of urgency for buyers—often, overpriced listings languish on the market and end up selling for less than they would have if they’d been priced more competitively from the get-go. Price too low, however, and you risk leaving money on the table if your home doesn’t attract multiple offers. So how do you price it right?

As agents, we track market conditions daily to understand where the “Goldilocks zone” lies for different neighborhoods and price points based on buyer demand and competing properties. Your best bet is to work closely with your agent on an effective pricing strategy before listing your home…BUT in the meantime, here’s some info to help you better understand what goes into this process.

- Understanding the Value of Your Home: Market Value vs. Assessed Value and More

- The Difference Between a Comparative Market Analysis and an Appraisal

What’s your home worth?

While nothing can replace an in-person evaluation by a real estate agent or appraiser, automated valuation models (AVMs) can be a helpful first step in determining what your home is worth. AVMs assess your home by comparing its information with the listings in your area. An algorithm can’t possibly know about the unique characteristics of your home or its neighborhood…but it can give you a rough ballpark idea of your home’s value and how it’s changing over time. Curious? Try our Home Worth Estimator here:

What factors influence home prices?

Understanding what factors influence home prices will give you a deeper knowledge of the market, give clarity to the selling process, and help you work with your agent to accurately price your home.

Comparable Home Sales

Comparable home sales—or “comps”—have a major impact on the price of your home. Comps refer to the comparable homes in your area, both pending and sold, within the last six months. Your Windermere agent can provide you with a Comparative Market Analysis (CMA) to better determine the price of your home. CMAs factor in aspects such as square footage, age, and lot size compared to other homes in your area, to determine how your home should be priced among the competition.

Your Home’s Location

Location, location, location. It plays one of the most significant roles in your home’s asking price. Market conditions in your area, whether you reside in a metropolitan, suburban, or rural location, and the home’s proximity to amenities, schools, and entertainment all contribute to the price.

Your Home’s Condition

If you have recently invested in upgrades or other remodeling projects for your home, they could increase your asking price. However, the price increase potential depends on the kind of renovation, its ROI, and how valuable it is to buyers in your area. If the home needs repair, it will likely generate less interest from buyers than better maintained homes at your price point. Any outstanding repairs or projects looming overhead will make the home less attractive to buyers and could lead to a low appraisal.

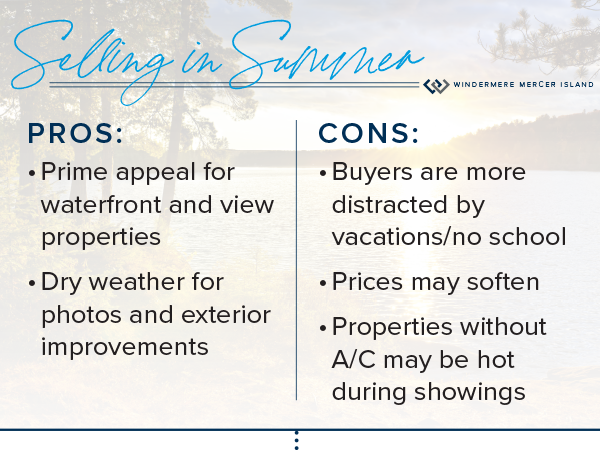

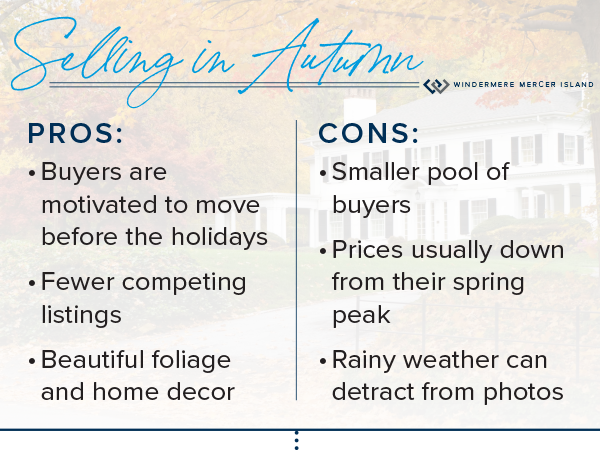

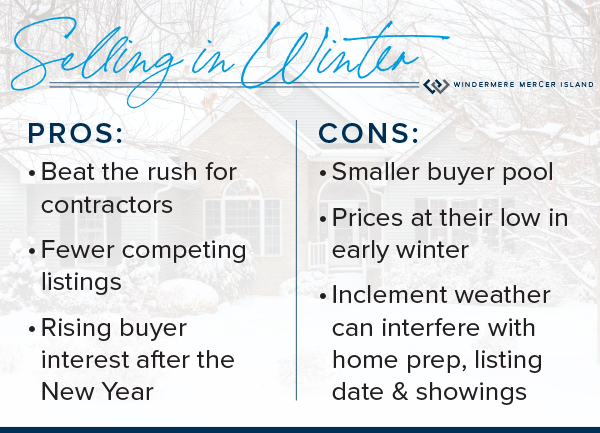

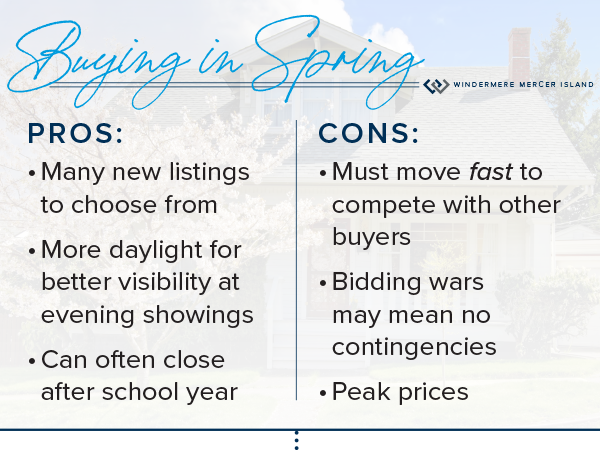

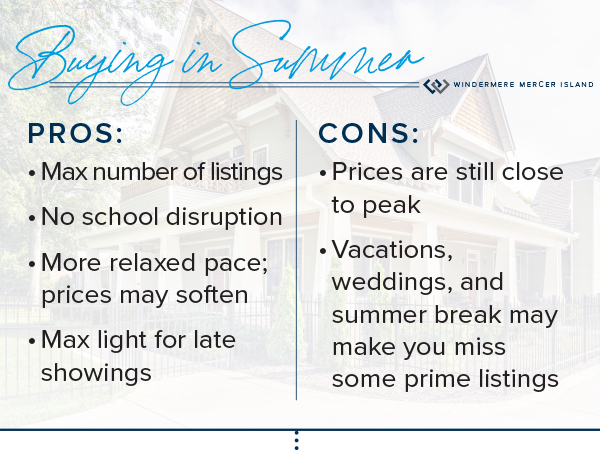

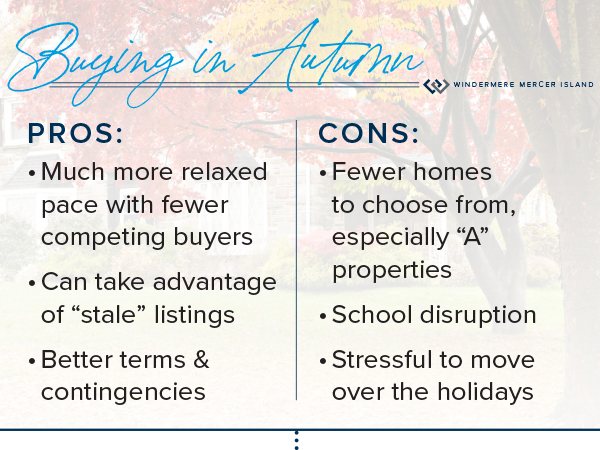

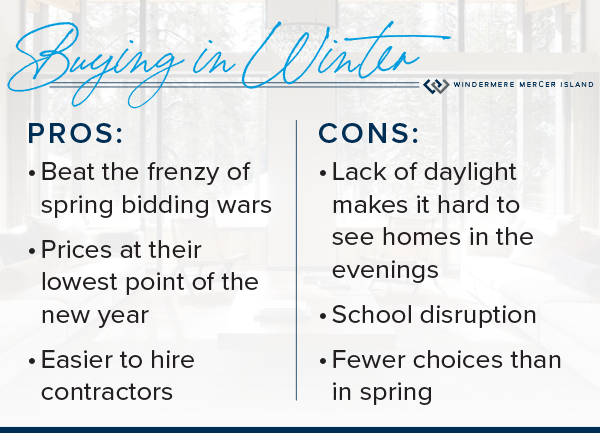

Seasonality

Any factors that impact market supply and demand are worth taking into consideration when preparing to price your home, and seasonality is one that cannot be overlooked. Typically, market activity slows in the winter and picks up during the spring and summer months. However, market seasonality varies region to region. Talk to your Windermere agent about the seasonality trends in your area and how they factor into your asking price.

Market Conditions

Finding a competitive listing price will be depend on local conditions, such as whether it’s a buyer’s or seller’s market. Some sellers think that pricing their home over market value means they’ll sell for more money, but the opposite can often be true. Overpricing your home presents various dangers such as sitting on the market too long, which can result in selling for well below what it’s worth.

Periodic Price Adjustments

Pricing a home isn’t a set-it-and-forget-it proposal. As with any strategy, you need to be prepared to adapt to fast-changing market conditions, new competition, a lack of offers, and other outside factors.

These are the basic tenets for understanding what goes into the price of a home. When you’re ready, a Windermere agent will interpret and expand on this information, perform a CMA for your home, and guide you throughout your selling journey.

Adapted from an article originally appeared on the Windermere blog October 5, 2022.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2025, Windermere Real Estate/Mercer Island.

2025 Seattle & Eastside Farmers Markets

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies).

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- First Hill

- Fremont

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- South Lake Union – Farmers Market

- South Lake Union – Saturday Market

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

Tuesdays, 3pm – 7pm (June 3 – September 30, 2025)

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 7 – Oct 15, 2025

37th Ave S & S Edmunds St | Seattle

seattlefarmersmarkets.org/ccfm

First Hill

A Pike Place Satellite Market, this small “express market” offers locally sourced veggies, fruits, flowers, honey, jam, and organic meats from the region’s finest farms.

Fridays, 10am – 2pm | June 20 – Sept 26, 2025

9th Avenue & University Street | Seattle

pikeplacemarket.org/market-programs-events/farmers-markets

Fremont

With a newly expanded Promenade encompassing two blocks along the Fremont Canal, you can find just about everything at this “hyper market”—an eclectic mix of a farmer’s market, flea market and artists’ alley. The food is pretty epic, too!

Sundays, 10am – 4pm | Year-Round

3401 Evanston Ave N | Seattle

fremontmarket.com

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 12 – Oct 2, 2025

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 11 – Oct 19, 2025

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 16 – Oct 31, 2025

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 7 – Oct 11, 2025

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 6 – Sept 26, 2025

6532 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm (farm tables close at 4pm) | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | May 29 – Oct 9, 2025

Spring Preview Market on May 10, 2025, 10am-3pm

Harvest Markets on Oct. 25 & Nov. 22, 10am-3pm

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Shoreline

Now located at the BikeLink Park & Ride (corner of 192nd & Aurora, across from Sky Nursery), this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods.

Saturdays, 10am – 2pm | June 7 – Oct 25, 2025

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

South Lake Union – Farmers Market

Affiliated with Pike Place Market, this small satellite market offers locally sourced veggies, fruits, flowers, honey, jam, and organic meats from the region’s finest farms.

Thursdays, 10am – 2pm | June 26 – Sept 25, 2025

426 Terry Avenue N | Seattle

pikeplacemarket.org/market-programs-events/farmers-markets/

South Lake Union – Saturday Market

Note the new location for 2025 on 6th Ave, next to The Spheres. More of a makers market along with vintage boutiques and food trucks…you won’t find traditional produce booths, but you will find brunch and plenty of retail therapy.

Saturdays, 11am – 4pm | June 7 – Sept 27, 2025

6th Ave & Lenora St | Seattle

slumarket.com

University District

Come visit Seattle’s largest and oldest farm/food only market, recognized as one of the best farmers markets in the U.S.! With over 80 booths and hard-to-find ingredients, it’s a chef’s delight.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 28 – Sept 24, 2025

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

West Seattle

A weekend destination for families across the area, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with hand crafted bird houses, candles, dog accessories, herbal wellness products, and more. Don’t miss the tacos, Nepalese street food, and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 3 – Sept 30, 2025

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Power of Produce (POP) club empowers kids to know where their food comes from and make healthy eating choices.

Thursdays, 3pm – 7:30pm | May 22 – Oct 2, 2025

(Closes at 7pm after Labor Day)

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2025

Tolt-MacDonald Park, 31020 NE 40th St | Carnation

carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursdays, 3pm – 7pm | May 1 – October 9, 2025

(Closes at Sunset in October)

Taylor Landing at 16201 Main St NE | Duvall

Parking Map

duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 10 – Sept 27, 2025

Pickering Barn, 1730 10th Ave NW | Issaquah

Market Map

www.issaquahwa.gov/778/Farmers-Market

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June 4 – September 24, 2025

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June 6 – Sept 26, 2025

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Mercer Island

Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 2pm | June 1 – Sept 28, 2025

Farmers Only Pop-Up Market: Oct 12, 2025

Harvest Market: Nov 23, 2025

Mercerdale Park, 7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Kids can participate in the Power of Produce (PoP) Club. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

June 5 – August 21, 2025: Thursdays, 4pm – 8pm (Closed 6/19 for Juneteenth)

August 28 – September 11, 2025: Thursdays, 3:30pm – 7:30pm

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 3 – Oct 25, 2025 (Closed May 10th)

9900 Willows Rd NE | Redmond

www.redmondsaturdaymarket.org

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton. Food trucks, live music, and kids’ activities make this a fun spot to liven up your Tuesday. Note: for 2025, the market has moved a couple of blocks to Williams Ave S while Piazza Park is being refurbished.

Tuesdays, 3pm – 7pm | June 3 – Sept 30, 2025

Willliams Ave S (Between S 2nd & S 3rd Streets) | Renton

www.rentonfarmersmarket.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May 7 – Sept 17, 2025

Sammamish Commons, 801 228 Ave SE | Sammamish

Parking: Mary, Queen of Peace Catholic Church, 1121 228th Ave SE

www.sammamishfarmersmarket.org

Woodinville

Come check out downtown Woodinville’s Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse.

Saturdays, 10am – 2pm | May 3 – Sept 27, 2025

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2025, Windermere Real Estate/Mercer Island.

How’s the Market? Annual Review of Seattle Area Real Estate

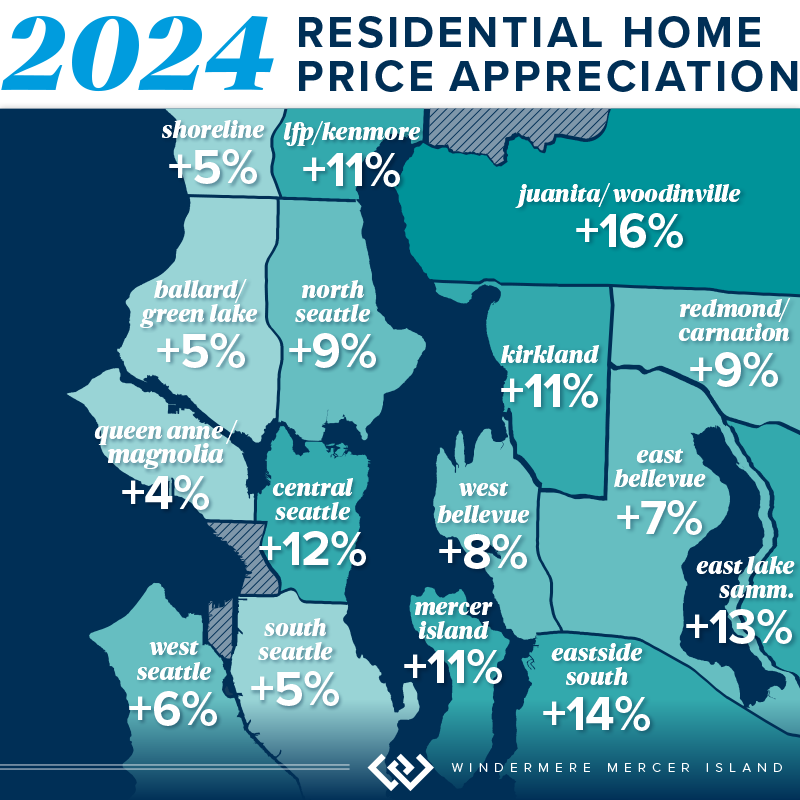

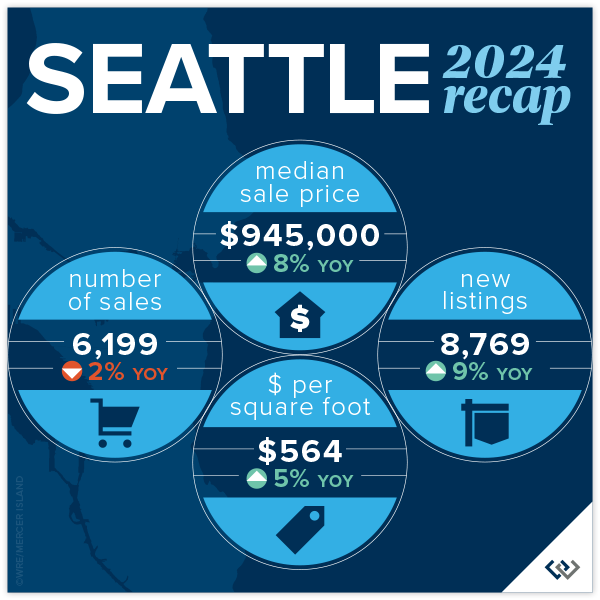

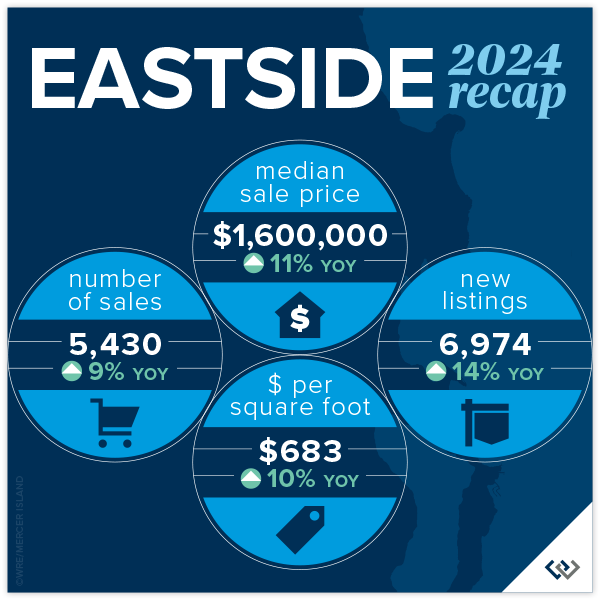

Happy New Year! Whew, we made it! With 2024 now in the books, we’re looking back fondly on a real estate market that showed positive signs of growth in virtually every sector. Median sales prices posted strong double-digit gains on the Eastside along with a healthy 8% rise in Seattle. Listings also rose, easing the strain for buyers grappling with our housing shortage.

If you’ve waited long enough and 2025 is the year for you to make a move, we recommend front loading that decision. Pent up demand (both sellers waiting to sell and buyers waiting to buy) should give us a spring full of blossoming and beautiful inventory. There is less volatility in interest rates than there has been in recent months, you’ll see that the average rate has been rock steady around 6.75% in 2023 and 2024. Overall, this is a great time to buy or sell and I know your real estate professional is excited to help you!

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

From a statistical/real estate perspective, the numbers don’t really reflect the overall vibe of the year. In a good way! It’s all positive news: prices are up, listings are up, and market time is down. The City of Seattle is in full recovery mode. Homeowners are awaiting the new density plan and eager to learn what the city has in store for the core neighborhoods around transit. It’s an exciting time. Median sold price city-wide reached a record $945,000 (modest, as that is $5000 above the previous record set in 2022) and homes sold for an average 104% of list price when they attracted a sale in the first 10 days (58% of the total sales).

Lake Forest Park and Madison Park saw the greatest price gains at 11% and 12% respectively. North Seattle was over all the “strongest” with 66% of homes selling in the first 10 days and 70% of homes selling for at or above list price. There was a modest gain in new listings across the board at 8769, while still lower than typical. The ten-year average is around 10,500 listings per year. No bad news here with average price per square foot gains of 5% to $564!

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

Welcome 2025! We (the real estate community) are feeling hopeful and bullish about what’s to come. So far, the numbers year over year support that. When we reviewed 2023 for the Eastside, the only positive statistic reported was Mercer Island’s 2% rise in the number of home sales. Looking at the 2024 report with that perspective it is ALL good news. New listings are up 14% for the year, while the number of sales are up nearly 10%. This is absorption of inventory to be excited about. Prices are up 11% to a record high of $1,600,000!

Woodinville and the area S of I-90 saw the largest price gains at 16% and 14% respectively, likely enjoying the benefits of buyers ‘pushing out’ because of the pressure of affordability in the core neighborhoods. Kirkland and West Bellevue were among the highest total sales and still a strong showing in price gains at 11% and 8%. Even though Bellevue (E of 405) saw the most modest price gains this was arguably the most popular neighborhood with 74% of homes selling in the first 10 days and 71% selling for at or above asking price!

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

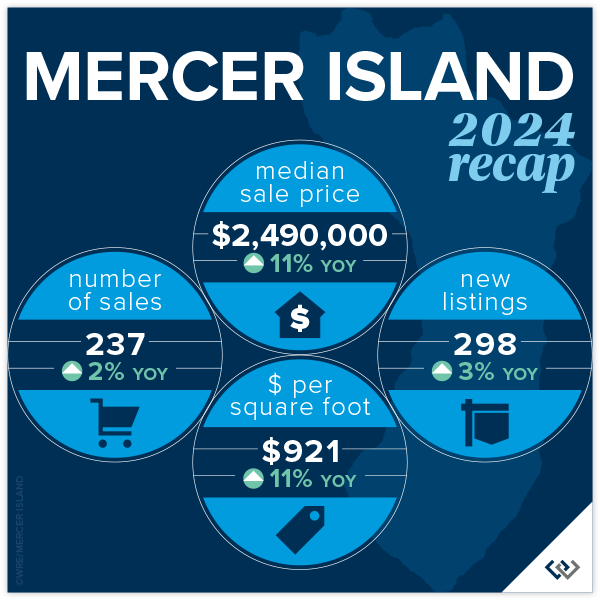

MERCER ISLAND

2024 was a solid year for Mercer Island: 11% overall price growth, on average 98% list to sales price ratio, and a respectable 32 cumulative days on market. This was a year of calm and confident decisions made by the entire real estate market. Home buyers and sellers alike. Looking to the neighborhoods there were two that stood out in relation to 2023: The Eastside and The Lakes where total sales had massive growth. 26 homeowners (vs 11 in 2023) moved on the Eastside and in the Lakes there were 4 transactions, a whopping change given that there were no sales reported on the MLS in 2023. The Island has not yet reached the peak prices from 2022, but we’re on our way!

Shifting to the condo market, 2024 was a sleepy year. With 47 new listings and 33 sales (both about 20% lower than in 2023), the average list to sales price ratio of 101% surprised us! Total median price is down YOY by about 8%, but with such little data to draw from this number tends to swing more than most. The overall price swing was from $339,000 for a studio to $1,775,000 for a 2 bedroom luxury unit. 19 of the 33 sales were 2 bedroom units. All in all condos on the island are a necessary market segment that we continue to watch closely as an overall indicator of market health.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

In reviewing last years’ report, there was so much RED! This year is a refreshing change with some positive numbers sprinkled in. Even the pockets that remain flat feel like good news, after all, a push is a win! Perspective is everything, in life and in real estate. This year was absolutely a bright spot for condos in the last several months. This was due in large part to external factors: affordability issues in single family, perceived ‘high’ interest rates, continued density issues in the ‘burbs, and major employers recall to office. Urban life in both Seattle and on the Eastside are experiencing a renaissance and we’re here for it!

The headline in Seattle is that prices are UP! Downtown saw an increase of 8% to a median price of $650,000. Though, North Seattle carried the day with an eye popping 18% increase in median price. While price per square foot was flat on average, new listings are up 21% YOY. Sellers are dipping their toes back in the market at higher prices (up 5.3%) and seeing moderate success with total sales down 3% (compared to a 26% drop in 2023). Buyers know they have options and will wait to pick off the low hanging fruit: best perceived value for their dollar.

Meanwhile, on the Eastside: prices are up, listings are up, sales are up. A nice headline, but let’s break it down. New listings rose a whopping 34% year over year (which you may remember saw a 23% dip from 2022). Demand was steady with total sales up 15% YOY; we didn’t quite absorb all of the new inventory but that is to be expected. So, even with a relatively high absorption rate prices rose to a record high median of $695,000. The stars of this price gain are, not surprisingly, Kirkland and West Bellevue at 28% and 24% respectively. We can’t wait to see what 2025 will bring!

Check out area-by-area details the full condo report.

WATERFRONT

The Eastside saw a huge boost in waterfront sales with 50% more sold in 2024 than 2023. Mercer Island and Lake Sammamish posted similar sales gains of 45% and 43% respectively. While Seattle had 2 fewer sales than the year prior, its waterfront homes sold faster than in any other area and fetched higher selling prices as compared to list prices.

The highest waterfront sale was $38,900,000 for an immense 13,590 sq. ft. Medina estate on 117 feet of Lake Washington shoreline. The most modest sale was $1,400,000 for a 1960 Ralph Anderson original on Seattle’s Arroyo Beach.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2025, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Michael Fleming and Clarity Northwest Photography. Mercer Island cover photo courtesy of The Sirianni Group and Clarity Northwest Photography. Condo cover photo courtesy of Luke Bartlett and Matthew Gallant, Clarity Northwest Photography.

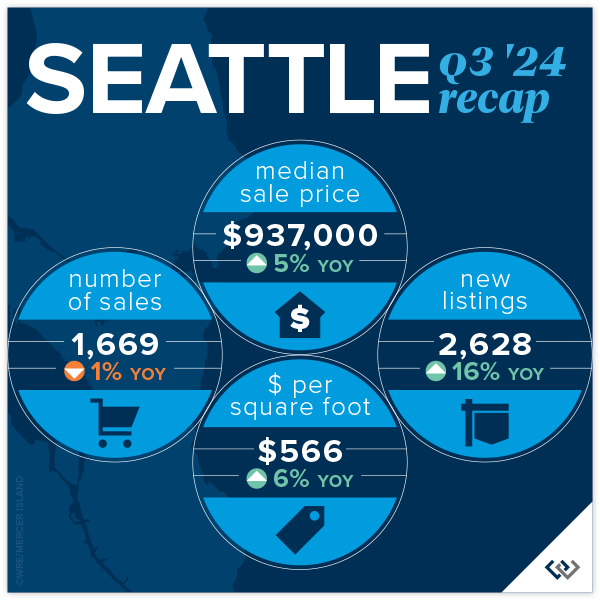

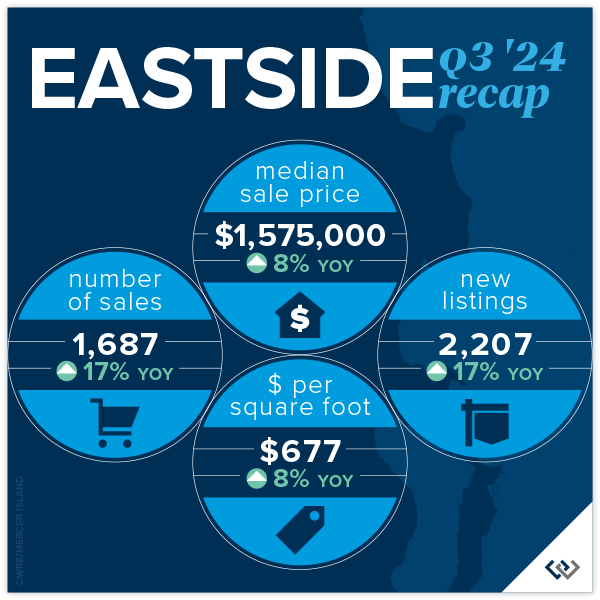

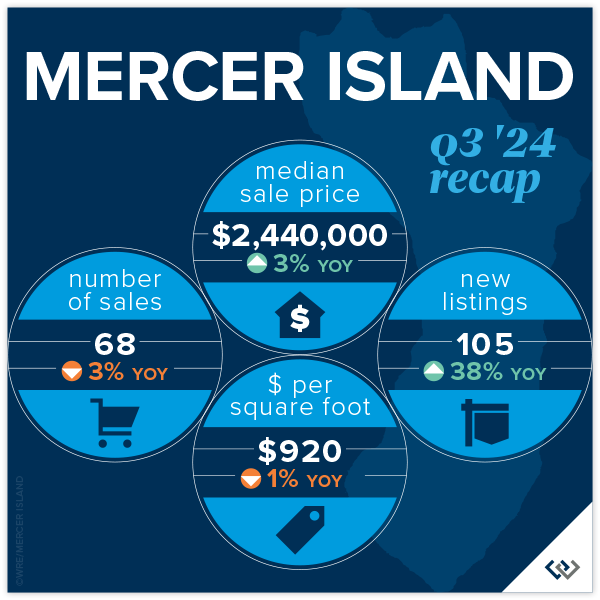

How’s the Market? Q3 2024 Review of Seattle Area Real Estate

While Q3’s summertime market slowed a bit from the frenetic spring pace of Q2 (we call this the “Summer Slump”), median home values are up across the region compared to this time last year. Most homes still sold at or above their listed prices in the first 10 days on market. However, buyers had more choice with higher inventory levels AND some room to negotiate on price for those homes that stayed on the market past the 10-day mark.

What does this mean for the rest of 2024? We typically see buyer activity decrease as we head into the holidays, and of course, it’s also election season. If you’ve been considering a purchase and are of the mindset that you don’t want to compete, THIS IS YOUR MARKET! For sellers the average days on market in Q3 was 20 for Seattle and 18 for the Eastside. Which means: if your price didn’t attract a buyer in the first two weeks, it’s probably time to re-evaluate. Interest rates are better than they’ve been since mid 2022. Quality inventory is being presented to the market. If you see a great house, be prepared to move quickly. Opportunity Knocks.

Click or scroll down to find your area report:

Seattle | Eastside | Mercer Island | Condos | Waterfront

SEATTLE

Lots of good news in Seattle during our post-summer glow. Prices are up year over year by 5% to $937,000. While we’re still under the peak median of $1,000,000 set in Q2 of 2022 and $970,000 from last quarter, this is so typical for Q3. We’ve seen it every year from Q2 to Q3 going back to 2018 (except in 2020 largely because the real estate market shut down completely in Q2). Buyers had lots of choice, with more inventory to end the quarter than we’ve had since Q3 of 2022. Even with these buyer bright spots we still saw 56% of homes sell in the first 10 days and 34% over the asking price.

Average price per square foot and median price were in positive territory across the board this quarter in all neighborhoods. Richmond Beach/Shoreline and Madison Park/Capitol Hill both saw larger than typical gains in $/sq.ft. (11%) and median price (10%) respectively. North Seattle appeared to be the “hottest” market around with 64% of homes selling in the first 10 days. Again, really great numbers in Seattle given that Summer Slump was in full effect.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

EASTSIDE

The Eastside continues to be the region’s crown jewel of real estate. Median prices are up again year over year by 8%. Most of us felt what we lovingly call the Summer Slump, and the numbers confirmed this. Prices (median) AND transactions were down 6% overall when compared against Q2 of 2024. That’s a $100,000 dip in median sales price if you missed the spring market. This is absolutely typical for the PNW and Metro King County. Seasonally our peak seasons are spring and post Labor Day/pre-holiday. This year that may be disrupted by election distractions. Time will tell if it’s a market lacking in consumer confidence or simply existential distraction.

The micro markets across the Eastside are fairly homogeneous. Among the 8 neighborhoods that we track, the median price swing was 3-11% but all in a positive direction. Total transaction volume is up 18% signaling that eventually life changes will trump a 2.5% interest rate. While homes were mostly selling in the first 10 days, multiple offers/paying over asking price were not the norm. In fact, the split between at, above, and below was relatively even.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

MERCER ISLAND

Fall has come for Mercer Island. The summer construction on Island Crest is done, school buses are out en force, and those filtered views that only come out in winter are starting to show. It’s time to look back fondly at the summer real estate market: prices are up YOY by 3% to $2,440,000 to end the quarter. This is likely more about trailing gains from a robust spring than it is about actual gains from Q3, given the indicators. A whopping 40% of homes sold under list price. It took 40% longer than 10 days to sell (not necessarily the same 40%) but only for about a 2% discount. This suggests that seller pricing and buyer motivation are evenly matched. There were 50 active listings at end of quarter, the most since Q2 of 2020 when real estate shut down completely.

Focusing on neighborhoods, The Lakes, Mercerwood, Mercerdale, and Mercer Island Estates saw 100% of homes sell in the first 10 days for an average of 102% of sales price. This goes to show that in any market, despite overall conditions, there will always be “hot homes.” Mid-Island had the most overall activity with 22 of the 68 sales across the Island. These occurred at $865/foot and 16 of the 22 homes sold in the first 10 days for at or above list price.

Click here for the full report and neighborhood-by-neighborhood statistics!

Click here for the full report and neighborhood-by-neighborhood statistics!

CONDOS – SEATTLE & EASTSIDE

Once again, we’re rooting for the Seattle condo market as it proves to be the little engine that could! Chugging along toward modest price gains even when the rest of the market seems to be struggling a bit, Seattle condo prices have held steady for the last 6 quarters, with mostly positive change. Eastside condos hit a median price all-time high in Q2 at $709,000. We’re off of that a touch to $690,000 in Q3, to be expected after a beautiful summer. The Eastside ended the quarter with 29% more listings than this time last year and only 13% more sales. Mounting inventory tends to lead to price softening. Overall, nearly 50% of condos sold for at or above their list price!

When you compare the charts in the report, there is admittedly more positive news on the Eastside than in Seattle. Overall, we’re encouraged that despite many neighborhoods experiencing a drop in sales, average price per sq. ft. held flat and median price is up overall. On the Eastside it’s still great news all around for the market, especially in West Bellevue with 26% median sales price gains and total sales up 55%.

Friendly PSA: PLEASE remember that there is a ‘first rung’ of the property ladder. CONDOS create an affordable option to start building wealth at a younger age. It’s an important real estate product that has been overlooked. I am hopeful that enterprising young homeowners return to the condo market in droves this next real estate cycle.

Check out area-by-area details the full condo report.

WATERFRONT

While a bit slower compared to last quarter, waterfront sales remained strong in Q3 with 10 on the Eastside and 8 in Seattle. Lake Sammamish moderated in summer with just 5 sales compared to the crazy 15 we saw in spring, while Mercer Island stayed fairly steady with 4 (compared to 6 in spring). The highest sale was nearly $18 million for an immense Wendell Lovett designed 6,920 sq. ft. home on 125 feet of prime “gold coast” waterfront in Medina. The most modest sale was also on the Eastside—an original 1943 cottage on 53 feet of west-facing waterfront in Kennydale.

This brief overview of the entire Seattle-Eastside private waterfront market, including Mercer Island and Lake Sammamish, illustrates the trends occurring in our region over time. This data is interesting and insightful but cannot replace an in-depth waterfront analysis with your trusted professional.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island. Information and statistics derived from Northwest Multiple Listing Service and Trendgraphix, and deemed accurate but not guaranteed. Seattle cover photo courtesy of Kathryn Buchanan and Brandon Larson, Clarity Northwest Photography. Mercer Island cover photo courtesy of The Sirianni Group and Clarity Northwest Photography. Condo cover photo courtesy of Julie Wilson and Bobby Erdt, Clarity Northwest Photography. Waterfront cover photo courtesy of Anni Zilz and Andrew Webb, Clarity Northwest Photography.

2024 Seattle & Eastside Farmers Markets: Locations, Times & More

Summer is just around the corner, and so are these farmers markets! Spend an evening or weekend finding your new favorites among the tents. Think it’s all about kale? Think again. Most offer live entertainment along with a mouth-watering variety of local brews, cheese, bread, meat/seafood, honey, hand roasted coffee, and other hidden gems (in addition to the freshly picked fruits & veggies).

Seattle Metro

- Ballard

- Capitol Hill (Broadway)

- Columbia City

- Lake City

- Lake Forest Park

- Madrona

- Magnolia

- Phinney

- Pike Place

- Queen Anne

- Shoreline

- U-District

- Wallingford

- West Seattle

Greater Eastside

- Bellevue – Crossroads

- Bellevue – Downtown

- Carnation

- Duvall

- Issaquah

- Kirkland – Downtown

- Kirkland – Juanita

- Mercer Island

- North Bend

- Redmond

- Renton

- Sammamish

- Woodinville

Seattle Metro

Ballard

Seattle’s first year-round Farmers Market, selling produce exclusively from Washington state farmers along the historic cobblestone stretch of Ballard Ave.

Sundays, 9am – 2pm | Year-Round

5345 Ballard Ave NW | Seattle

sfmamarkets.com/visit-ballard-farmers-market/

Capitol Hill (Broadway)

Come for Sunday brunch from food vendors who source ingredients from local, WA state farms (many of whom you’ll also meet selling their wares at the market). Live music and street performers often make an appearance, too.

Sundays, 11am – 3pm | Year-Round

Tuesdays, 3pm – 7pm (June 4 – September 24, 2024)

E Barbara Bailey Way | Seattle

seattlefarmersmarkets.org/chfm

Columbia City

With everything from freshly harvested Asian greens to Ethiopian eats, come check out the immense variety King County’s most diverse zip code has to offer. Bring your bounty to adjacent Columbia Park for a picnic.

Wednesdays, 3pm – 7pm | May 1 – Oct 9, 2024

Special Market Days on Saturday, 11/9/24 & 12/14/24, 10am-2pm

37th Ave S & S Edmunds St | Seattle

seattlefarmersmarkets.org/ccfm

Lake City

This celebrated North End seasonal market offers unique finds grown and prepared by local farms and food artisans. Enjoy kids’ activities, too!

Thursdays, 3pm – 7pm | June 13 – Oct 3, 2024

NE 125th St & 28th Ave NE | Seattle

seattlefarmersmarkets.org/lcfm

Lake Forest Park

With an emphasis on fresh, locally grown food, this market is an epicurean’s delight. Browse hard cider, baked goods, preserves, meat, pasta, sauces, and prepared foods along with the locally harvested fruits and veggies. There is also one “Crafts Market” each summer featuring local artisans.

Sundays, 10am – 2pm | May 12 – Oct 20, 2024

17171 Bothell Way NE | Lake Forest Park

www.thirdplacecommons.org/farmers-market

Madrona

Located in one of Seattle’s most diverse neighborhoods, you’ll find artisan foods as well as seasonal produce from Washington state farmers, fishers, and ranchers.

Fridays, 3pm – 7pm | May 17 – Oct 25, 2024

MLK Way & E Union St | Seattle

sfmamarkets.com/madrona-farmers-market

Magnolia

This popular Saturday market is nestled in the tree-lined Magnolia Village. In addition to seasonal fruits and veggies, you’ll find sweet & savory pies, fresh bread, flowers, and more!

Saturdays, 10am – 2pm | June 1 – Oct 12, 2024

W McGraw St & 33rd Ave W | Seattle

seattlefarmersmarkets.org/mfm

Phinney

A popular gathering spot for both the Phinney Ridge and Greenwood communities, this market is right next door to a playground and offers live music in addition to the great mix of fresh produce and prepared food.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

6532 Phinney Ave N | Seattle

seattlefarmersmarkets.org/pfm

Pike Place

No introduction needed…make it a day with great restaurants, eateries and retail shops, too.

Daily, 9am – 6pm (farm tables close at 4pm) | Year-Round (Closed Thanksgiving & Christmas)

Pike Place between Pine & Virginia St | Seattle

(206) 682-7453

pikeplacemarket.org

Queen Anne

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Thursdays, 3pm – 7:30pm | May 30 – Oct 10, 2024

Spring Preview Market on May 11, 2024, 10am-3pm

Harvest Markets on Oct. 26, Nov. 23 & Dec. 14, 2024, 10am-3pm

Queen Anne Ave N & W Crockett St | Seattle

qafm.org

Shoreline

Now located at the BikeLink Park & Ride (corner of 192nd & Aurora, across from Sky Nursery), this market offers kids’ programs and live music in addition to its fresh Washington produce, organic meats, bread, honey, and prepared foods.

Saturdays, 10am – 2pm | June 1 – Oct 5, 2024 + Harvest Markets on Oct. 26 & Dec. 14

18821 Aurora Ave N | Shoreline

shorelinefarmersmarket.org

University District

Seattle’s only independent farmers market, offering food, chef demos, live music, and children’s activities.

Saturdays, 9am – 2pm | Year-Round

University Way NE (the “Ave”) between 50th & 52nd | Seattle

seattlefarmersmarkets.org/udfm

Wallingford

Located in Meridian Park, you can shop with the whole fam and then enjoy a picnic or playtime at the award-winning playground.

Wednesdays, 3pm – 7pm | May 29 – Sept 25, 2024

4800 Meridian Ave N | Seattle

sfmamarkets.com/visit-wallingford-farmers-market/

West Seattle

A South Seattle weekend destination, this market is set in the vibrant West Seattle Junction and features up to 70 vendors during the summertime peak. Great community atmosphere celebrating Washington grown food and ingredients.

Sundays, 10am – 2pm | Year-Round

California Ave SW & SW Alaska | Seattle

seattlefarmersmarkets.org/wsfm

Greater Eastside

Bellevue – Crossroads

East Bellevue’s market features fruits, veggies & dairy products from Washington state farms along with handmade soaps, candles, dog treats, herbal wellness products, and more. Don’t miss the Salvadorean pupusas, Russian-style crepes, and handmade ice cream sandwiches, too!

Tuesdays, 12pm – 6pm | June 4 – Sept 24, 2024

15600 NE 8th St | Bellevue

https://crossroadsbellevue.com/music-events/crossroads-farmers-market/

Bellevue – Downtown

Set in the heart of Downtown Bellevue, this market offers goods exclusively produced within Washington state—from seasonal fruits & veggies to flowers, fresh meats, artisan goods, and prepared cuisine. The Power of Produce (POP) club empowers kids to know where their food comes from and make healthy eating choices.

May 23 – Sept 26, 2024: Thursdays, 3pm – 7pm

Oct 3-24: Thursdays, 3pm-6pm

1717 Bellevue Way NE | Bellevue

bellevuefarmersmarket.org

Carnation

Set in the heart of the Sno-Valley farming district, you’ll find plenty of freshly picked produce along with live music and educational activities for the kids.

Tuesdays, 3pm – 7pm | June, July & August 2024

Tolt-MacDonald Park, 31020 NE 40th St | Carnation

carnationfarmersmarket.org

Duvall

Nestled alongside the scenic Snoqualmie River, this friendly market features local eggs, jams, fresh roasted coffee, arts, crafts, and baked goods in addition to the seasonal veggies, fruits, and plant starts. Live music, picnic shelters and a playground make this a fun family destination.

Thursdays, 3pm – 7pm | May 2 – October 10, 2024

Taylor Landing at 16201 Main St NE | Duvall

Parking Map

duvallfarmersmarket.org

Issaquah

Located at the historic Pickering Barn, this picturesque venue offers a variety of fresh farm and food-based products, concessions, and local artisans.

Saturdays, 9am – 2pm | May 4 – Sept 28, 2024

Holiday Markets on Oct 26, Nov 23, & Dec 14, 2024

Pickering Barn, 1730 10th Ave NW | Issaquah

Market Map

www.issaquahwa.gov/778/Farmers-Market

Kirkland – Downtown

This stunning setting on the Lake Washington shoreline turns shopping into a day at the beach. Peruse local produce and goods, then go for a swim or stroll along Moss Bay. Perfect for a picnic, too!

Wednesdays, 3pm – 7pm | June 5 – September 25, 2024

Marina Park, 25 Lakeshore Plaza | Kirkland

kirklandmarket.org

Kirkland – Juanita

Set in beautiful Juanita Beach Park on Lake Washington, you’ll find as many as 30 vendors offering farm fresh local produce, herbs, honey, nuts, flowers, plants, baked good, handcrafted items, and prepared cuisine. Make it a date with live music and a picnic at the beach. There’s a great playground for the kids, too.

Fridays, 3pm – 7pm | June 7 – Sept 27, 2024

Juanita Beach Park, 9703 NE Juanita Dr | Kirkland

www.kirklandwa.gov

Mercer Island

Come on down for quality local Washington state produce, cheese, fish, meat, bread, and more. Check out the live music schedule, too!

Sundays, 10am – 2pm | June 2 – Sept 29, 2024

Harvest Market on Nov 24, 2024

Mercerdale Park, 7700 SE 32nd St | Mercer Island

www.mifarmersmarket.org

North Bend

This relaxed market enjoys live music and a spectacular Mount Si view. Vendors offer fresh produce, berries, honey, flowers, baked goods, hand-crafted items, and delicious prepared foods. Two playgrounds plus play fields and a covered picnic shelter make this a fun hangout spot. Leashed pets are welcome, too!

June 6 – August 22, 2024: Thursdays, 4pm – 8pm (Closed July 4)

August 29 – September 12, 2024: Thursdays, 3:30pm – 7:30pm

Si View Park, 400 SE Orchard Dr | North Bend

www.siviewpark.org/farmers-market.phtml

Redmond

Going strong since 1976, the Redmond Saturday Market offers a huge selection of vendors and dazzling array of produce, flowers, cheeses, preserves, salmon, tea, and handmade goods such as pottery and soaps. You’ll love the ready-to-eat foods, too.

Saturdays, 9am – 2pm | May 11 – Oct 26, 2024

9900 Willows Rd NE | Redmond

www.redmondsaturdaymarket.org

Renton

Find exclusively Washington-produced fruits, veggies, handmade goods, arts, crafts and more right in the heart of downtown Renton at Piazza Park. Food trucks, live music, and kids’ activities such as the “Healthy Kids Corner” make this a fun spot to liven up your Tuesday.

Tuesdays, 3pm – 7pm | June – Sept, 2024

Piazza Park, 233 Burnett Ave. S | Renton

www.rentonfarmersmarket.com

Sammamish

Each Wednesday, the Sammamish Commons plays host to a variety of local farmers, nurseries, bakeries, artisans, food vendors, and more. Live music and kids’ activities, too!

Wednesdays, 4pm – 8pm | May 15 – Sept 25, 2024 (Closed July 3)

Sammamish Commons, 801 228 Ave SE | Sammamish

www.sammamishfarmersmarket.org

Woodinville

Note the new hours for 2024! Come check out downtown Woodinville’s Schoolhouse District and find produce grown in the state of Washington (and picked fresh for that morning!). You’ll also have an array of boutique baked goods, sauces, cider, artisans, and more to peruse. Check out the calendar for live entertainment, music, demos, and other activities.

Saturdays, 10am – 2pm | May 4 – Sept 28, 2024

13205 NE 175th St | Woodinville

woodinvillefarmersmarket.com

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island.

Top 10 Predictions for 2024 Real Estate

Will 2024 be a good year for real estate? This question comes up a LOT, especially from those who are considering buying or selling a home in the near future. Housing economist Matthew Gardner weighed in with his top 10 predictions for what the real estate market will look like in the coming year. Here is what he had to say…

1. Still no housing bubble

This was number one on my list last year and, so far, my forecast was spot on. The reason why I’m calling it out again is because the market performed better in 2023 than I expected. Continued price growth, combined with significantly higher mortgage rates, might suggest to some that the market will implode in 2024, but I find this implausible.

2. Mortgage rates will drop, but not quickly

The U.S. economy has been remarkably resilient, which has led the Federal Reserve to indicate that they will keep mortgage rates higher for longer to tame inflation. But data shows inflation and the broader economy are starting to slow, which should allow mortgage rates to ease in 2024. That said, I think rates will only fall to around 6% by the end of the year.

3. Listing activity will rise modestly

Although I expect a modest increase in listing activity in 2024, many homeowners will be hesitant to sell and lose their current mortgage rate. The latest data shows 80% of mortgaged homeowners in the U.S. have rates at or below 5%. Although they may not be inclined to sell right now, when rates fall to within 1.5% of their current rate, some will be motivated to move.

4.Home prices will rise, but not much

While many forecasters said home prices would fall in 2023, that was not the case, as the lack of inventory propped up home values. Given that it’s unlikely that there will be a significant increase in the number of homes for sale, I don’t expect prices to drop in 2024. However, growth will be a very modest 1%, which is the lowest pace seen for many years, but growth all the same.

5. Home values in markets that crashed will recover

During the pandemic there were a number of more affordable markets across the country that experienced significant price increases, followed by price declines post-pandemic. I expected home prices in those areas to take longer to recover than the rest of the nation, but I’m surprised by how quickly they have started to grow, with most markets having either matched their historic highs or getting close to it – even in the face of very high borrowing costs. In 2024, I expect prices to match or exceed their 2022 highs in the vast majority of metro areas across the country.

6. New construction will gain market share

Although new construction remains tepid, builders are benefiting from the lack of supply in the resale market and are taking a greater share of listings. While this might sound like a positive for builders, it’s coming at a cost through lower list prices and increased incentives such as mortgage rate buy downs. Although material costs have softened, it will remain very hard for builders to deliver enough housing to meet the demand.

7. Housing affordability will get worse

With home prices continuing to rise and the pace of borrowing costs far exceeding income growth, affordability will likely erode further in 2024. For affordability to improve, it would require either a significant drop in home values, a significant drop in mortgage rates, a significant increase in household incomes, or some combination of the three. But I’m afraid this is very unlikely. First-time home buyers will be the hardest hit by this continued lack of affordable housing.

8. Government needs to continue taking housing seriously

The government has started to take housing and affordability more seriously, with several states already having adopted new land use policies aimed at releasing developable land. In 2024, I hope cities and counties will continue to ease their restrictive land use policies. I also hope they’ll continue to streamline the permitting process and reduce the fees that are charged to builders, as these costs are passed directly onto the home buyer, which further impacts affordability.

9. Foreclosure activity won’t impact the market

Many expected that the end of forbearance would bring a veritable tsunami of homes to market, but that didn’t happen. At its peak, almost 1-in-10 homes in America were in the program, but that has fallen to below 1%. That said, foreclosure starts have picked up, but still remain well below pre-pandemic levels. Look for delinquency levels to continue rising in 2024, but they will only be returning to the long-term average and are not a cause for concern.

10. Sales will rise but remain the lowest in 15 years

2023 will likely be remembered as the year when home sales were the lowest since the housing bubble burst in 2008. I expect the number of homes for sale to improve modestly in 2024 which, combined with mortgage rates trending lower, should result in about 4.4 million home sales. Ultimately though, demand exceeding supply will mean that sellers will still have the upper hand.

About Matthew Gardner

Matthew Gardner analyzes and interprets economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

Matthew also sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Adapted from an article that originally appeared on the Windermere blog December 4th, 2023. Written by: Matthew Gardner.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link