Selling Your Home: 5 Common Myths

Selling your home is a crash course in real estate education. You’ll learn how to work with your real estate agent to find a buyer and sell at the right price. As you prepare to sell, it’s important to remember that that not everything you’ve heard is true. There are several common myths that can lead to costly mistakes in the selling process. Knowing the truth behind them will clarify your selling journey and help you align your expectations…

Myth 1: Home Value Calculators Are 100% Accurate

Online Automated Valuation Models (AVMs) are a great starting point for understanding how much your home could be worth. However, they are merely a first step in determining home value; to say they are 100% accurate is a myth. When it comes to pricing your home, you need to rely on your real estate agent’s Comparative Market Analysis (CMA), which uses vast amounts of historical and current data on real estate listings to arrive at an accurate and competitive figure.

To get an estimate of how much your home is worth, try our Home Worth Calculator here:

Myth 2: Selling FSBO Will Save You Money

Selling a home requires an intimate knowledge of the housing industry and how to solve the complex situations that arise throughout a real estate transaction. Despite this, some sellers will go it alone and attempt to sell their property without being represented by an agent.

Selling For Sale by Owner (FSBO) is a risky proposition. It requires the seller to bear added liability, fills their schedule with various marketing and promotional responsibilities, and can leave money on the table by inaccurately pricing the property, causing it to sit on the market for too long. The potential costs of selling a home on your own far outweigh the compensation real estate agents earn on a home sale.

Myth 3: You Must Remodel to Sell Your Home

The question you’ll face when preparing to sell your home is whether to sell as is or remodel. The answer usually lies somewhere in between, but it depends on your situation and what kinds of home upgrades are driving buyer interest locally. When making improvements to your home, lean toward high ROI remodeling projects to get the best bang for your buck, and avoid trendy projects that can delay listing your home. If you’re considering major upscale renovations, talk to your agent about which projects buyers in your area are looking for.

Myth 4: Never Accept the First Offer

You’ve likely heard tell that the first buyer’s offer is nothing more than a springboard to up your asking price and to never accept it. In this case, “never” should be approached with caution. In reality, the best offer for your home is one that you and your agent have discussed that aligns with your goals. If a matching offer happens to be the first one that comes your way, so be it. The market can shift at any time, so you never know what may happen if you leave an offer on the table. And if the buyer backs out of the deal, you and your agent will find a path forward.

Myth 5: Home Staging Doesn’t Make a Big Difference

Staging your home is so much more than a cosmetic touch-up; it has been proven to help sell homes faster and at a higher price than non-staged homes.1 Staging ensures that your home has universal appeal, which attracts the widest possible pool of potential buyers. When buyers are able to easily imagine living in your home, they become more connected to the property. You should stage your home regardless of your local market conditions, but it can be especially helpful in competitive markets with limited inventory where even the slightest edge can make all the difference for sellers.

Now that you know some of the most common myths in the selling process, get to know its truths. Connect with a local Windermere agent to get the process started:

1: National Association of REALTORS® – Why Home Staging Inspires the Best Prices in Any Housing Market

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

Understanding Contingent Offers: A Seller’s Guide

With the market shifting toward balance between buyers & sellers, “contingent” is a word sellers will be seeing more of. It’s important to understand the difference between a “contingent offer” and one with “contingencies.” Contingent offers allow the buyer time to sell their current home first before they complete the purchase. On the other hand, an offer with contingencies allows the buyer to cancel the contract with a full earnest money refund if the specified conditions aren’t met—often a satisfactory home inspection or the ability to obtain financing.

This may feel a bit like buyers want to have their cake and eat it too, but every homeowner can understand the desire to protect their investment before fully diving in. In a seller’s market, there are fewer homes available, which means buyers will do whatever they can to make their offer stand out. Because sellers have the leverage in these market conditions, you’ll often see buyers waiving their contingencies. Talk to your agent for more information about the local market conditions in which you’re selling.

Should I accept a contingent offer on my house?

Each home sale is different, and each seller has a unique story. What you’re looking for in an offer may be different from what someone else in your neighborhood is looking for when selling their home. It all depends on your circumstances, your timeline, your next steps, and your local market conditions. The extra stipulations in a contingent offer require the attention of an experienced real estate agent who can interpret what they mean for you as you head into negotiations.

How often do contingent offers fall through?

Contingent offers can fall through more often than non-contingent ones, but there’s no general rule of thumb. Whether a sellers and buyer are able to agree on the terms of a deal is a case-by-case situation. Different contingencies may carry different weight among certain sellers, and local market conditions usually play a significant role. For up-to-date information about your local market, visit our Market Reports page or Trends on our blog.

Pros and Cons of Contingent Offers for Sellers

Pros of Contingent Offers (allowing the buyer to sell their current home first):

- Accepting a contingent offer means you don’t have to take your home off the market quite yet, since the conditions of the deal haven’t been met. If the buyer backs out of the deal, you can sell without having to re-list.

- In certain cases, some buyers may be willing to pay extra to have their contingent offer met even if the home has been on the market for an extended period.

Pros of Offers with Contingencies (such as inspection, title, financing, etc.):

- You’ve got an offer! In a balanced market, one offer with contingencies is still better than no offers.

- It may protect you legally if you give the buyer the opportunity to do all of their due diligence while under contract. It’s harder for a buyer to come back and say something wasn’t disclosed when they had ample time and the contractual right to due diligence.

Cons:

- Home sales with any types of contingencies are usually slower than those without. It takes time to satisfy a buyer’s contingencies and additional time to communicate that they have been met.

- There’s a higher risk that the deal could fall through since the the buyer isn’t locked into the contract until of their contingencies have been satisfied.

As always, trust your agent for guidance when facing contingent offers. Connect with one of our local Windermere Mercer Island agents for expert advice:

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

9 Fun Summer DIY Projects for Your Home

Sun’s out…fun’s out! Our glorious PNW summer is coming in hot with endless opportunities to enjoy the outdoors. Here are some fun and easy project ideas to help you make the most of it!

1. Backyard Movie Theater

Outdoor movies are a great way to enjoy your yard and entertain a crowd (and keep the mess outside, too!). Looking for affordable and easy? You can find portable, outdoor, Bluetooth enabled projectors for under $100; hang up a white sheet or inexpensive screen, grab your portable Bluetooth speaker, and BOOM…it’s movie time. Ready to take the leap and create something more lasting? Here is a great how-to for a wooden frame with pull-down screen + helpful tips for your AV setup.

2. Fire Pit

Who doesn’t love a good s’mores roast? Creating an attractive fire pit may be easier and cheaper than you imagined. One beautifully simple method we love is to create a ring of stacked bricks, stones or cinder blocks on top of a level pea gravel base, then place a store-bought metal fireplace bowl in the center (here is the full how-to). It’s remarkably fast and you don’t even need mortar! You can also go for a modern square look with cinder blocks, use a reclaimed metal receptacle, or find a full kit at the hardware store. Check out this list of 31 DIY fire pit ideas from the Spruce.

3. House Number Planter

Looking to add some instant curb appeal to your home? This elegant, inexpensive design may just be the “WOW!” you’re looking for. Choose modern house numbers for an updated look and then a little wood, some pretty plants, and a couple hours of work is all it takes to make your neighbors jealous.

Photo courtesy of ana-white.com

4. Giant Backyard Jenga

We LOVE this idea for summer BBQs, and it’s so easy! All you need are some 2×3 boards, a miter saw, and sandpaper (or a power sander, if you have one). Bada bing bada boom…jumbo Jenga to entertain kids and adults alike. Here are full instructions courtesy of Her Tool Belt, including the option to go fancy with colors and a DIY carrying crate that also doubles as a stand.

5. Decorative A/C Screen

If you’re lucky enough to have central A/C, you’re also unlucky enough to have an unsightly metal unit sitting in your yard. Fortunately, you can build a simple cover for less than $100 and in less than a day. Here is an easy plan from This Old House, designed with widely spaced slats for air flow and 1 foot of clearance (do your homework on your specific A/C unit before you dive in—you may need to size up). You can paint it to match your house color if you want to go incognito, or stain it for a stylish natural wood look.

Photo courtesy of tarynwhiteaker.com

6. Vertical Garden

Taking advantage of vertical space for planting means that even the smallest of patios can host a garden. It could be as simple as attaching pots to a trellis/rail or framed chicken wire, or something more elaborate like this beautiful living wall by This Old House. Vertical gardens can also double as privacy screens for your yard, porch or patio. Veggie enthusiasts can even build this easy vertical ladder planter with its own drip watering system. For the ultimate quick fix, felt pocket planters offer instant gratification—just attach to your fence or wall, add potting soil + slow release fertilizer + drought-tolerant plants, and water every 2 days. Using freestanding shelves for your container garden is another great option, especially for tenants who need something that is easily removable.

7. Leopold Bench

We love conservationist Aldo Leopold’s simple and iconic wooden bench plan, designed to be used both forward (with a backrest) or backward (where the backrest becomes an elbow rest for using binoculars). Here is a super easy DIY plan with cutting instructions from Construct101. Even amateurs can build this in less than a day, and all it takes are three boards, 6 carriage bolts, and some screws!

Photo courtesy of etsy.com

8. Hose Storage Planter

This ingenious project will boost your curb appeal in two ways, both by being an attractive planter AND by stowing away unsightly hoses in a clever hidden storage compartment. There are a few different styles and plans out there. We like this version from DIY Candy with a hinged front that allows you to access the hose without having to lift up the heavy planter. It can be crafted from a pallet or any other reclaimed wood. The Kim Six Fix also has this version made with cedar fence boards instead.

Photo courtesy of diycandy.com

9. Rain Garden

Did the April showers leave your yard (or basement) a little soggy? Sump pump working overtime? A rain garden is a beautiful way to channel water away from your house while also helping the environment by keeping chemical runoff out of rivers and lakes. The concept is pretty simple: create a below-grade garden bed planted with deep-rooted species that help capture and drain water rapidly into the soil. If you’re serious about improving drainage, you’ll also want either a stone channel or buried PVC pipe to help guide water from your downspout into the garden. Collect some friends to help with the digging! Here are full instructions from the Family Handyman.

If you’re considering selling your home, some of these projects—like planters and vertical garden privacy screens—can help maximize your curb appeal. A rain garden might also be a beautiful solution for drainage issues that need to be resolved before your house can go on the market. Looking for more ideas or advice? Reach out to us any time…we’re never too busy to help!

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island.

Remodeling Projects to Avoid When Selling Your Home

It’s common for homeowners to feel compelled to remodel their homes before they sell. Renovating the spaces in your home can increase its value and help you compete with comparable listings in your area. However, some remodeling projects are more beneficial than others as you prepare to sell your home. Always talk to your agent to determine which projects are most appealing to buyers in your area.

When preparing to sell your home, you want to strike the right balance of upgrades. Making repairs and executing renovations will attract buyer interest, but you don’t want to dump so much cash into remodeling that you won’t be able to recoup those expenses when your home sells.

So, how do you know where to focus your efforts? Your agent is a vital resource in understanding your specific situation and will offer guidance on your remodeling efforts to sell your home for the best price. Here are a few projects sellers will want to keep off their to-do lists for the best return on investment…

Major, Pricey Upgrades with Long Timelines

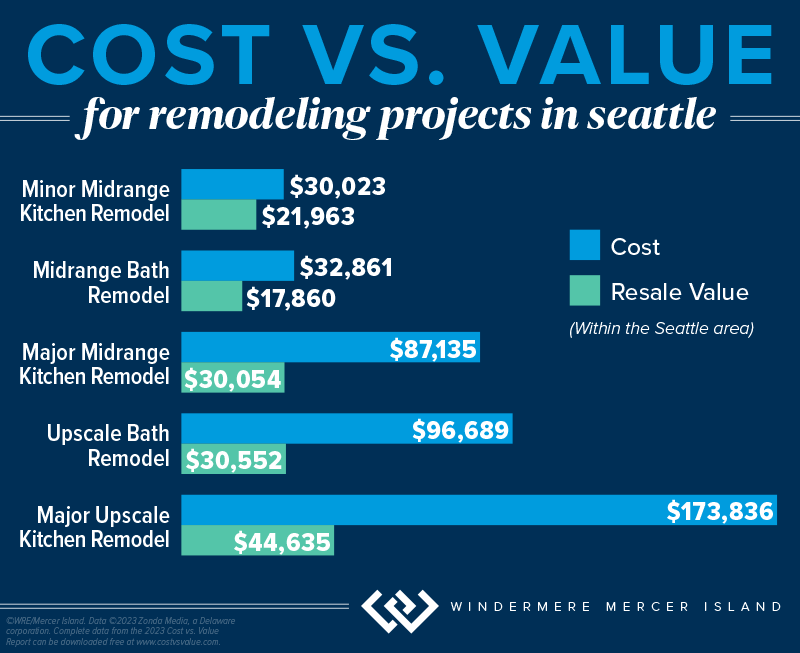

For any remodeling project, your agent’s analysis will be key to helping you determine its risk/reward potential. This dynamic is especially important for big remodels and home upgrades, due to their higher costs. The latest Remodeling Cost vs. Value Report (www.costvsvalue.com)1 data for the Seattle area shows a generally negative return on investment for major, upscale remodeling projects—they only recouped about 25%-30% of their cost…

These projects come with hefty price tags and longer timelines than minor repairs and upgrades, which can complicate factors as you prepare to sell, especially if you have a deadline to get into your new home. They have the potential to temporarily displace you from the property, meaning you and your household may have to find somewhere else to stay until the project is complete.

The Bottom Line: To go through with a major home upgrade before you sell, its schedule must fit with your moving timeline. It should also align with buyer interest in your local market. If the project doesn’t meet these criteria, it should be avoided.

Non-Permitted Projects & Building Code Violations

Before you decide to finish out the basement or make changes to your home’s wiring/structure/mechanical systems, it is important to make sure you obtain the proper city, county and/or state permits + inspections. Non-permitted square footage does not reflect on the county tax record and can lead to low appraisals when the buyer tries to get a loan. Obtaining permits also helps ensure your alterations meet the current building code—otherwise, you may face legal exposure should they create a safety hazard. Furthermore, any non-permitted remodels must be disclosed to the buyer on your Form 17 if you live in Washington State. The buyer’s mortgage lender may also have stipulations saying that the loan may not be used to purchase a home with certain features that aren’t up to code, which could lead to them backing out of the deal.

If you’re selling an older home, you’re not obligated to update every feature that may be out of code to fit modern standards. These projects are often structural and require a significant investment. If the violation in question was built to code according to the regulations at the time, then a grandfather clause typically applies. However, you’ll need to disclose these features to the buyer.

Trendy Makeovers and Upgrades

Lastly, it’s best to avoid remodeling projects that target a specific trend in home design. Trends come and go. Timeless design is a hallmark of marketable homes because it appeals to the widest possible pool of buyers. Keep this in mind when staging your home as well. Creating an environment that’s universally appealing and depersonalized allows buyers to more easily imagine the home as their own.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island.

1©2023 Zonda Media, a Delaware corporation. Complete data from the 2023 Cost vs. Value Report can be downloaded free at www.costvsvalue.com.

Adapted from an article that originally appeared on the Windermere Blog, written by: Sandy Dodge.

Tax Benefits Every Homeowner Should Know About

It’s tax season again, but being a homeowner might just make it rain at refund time. Check out the tax-deductible expenses, exemptions, and credits below. Whether you own a house, condo, or mobile home, they can save you big money when you file. Just be sure to compare your total itemized deductions against the standard deduction and see which is higher (you’ll have to choose between standard OR itemized on your return). It’s also good to know what you can’t deduct before you land in hot water with the IRS…

Mortgage Interest

A house payment is comprised of two parts: principal and interest. The principal goes toward reducing the amount you owe on your loan and is not deductible. However, the interest you pay is deductible as an itemized expense on your tax return. You can generally deduct interest on the first $750,000 of your mortgage (or $375,000 each if you’re married filing separately) if you purchased your home after December 15th 2017. Those who purchased earlier (10/14/1987 – 12/15/2017) can deduct interest paid on up to a $1m mortgage.

Property Taxes

You can deduct up to $10,000 of property taxes you paid (or $5,000 if you’re married filing separately). If you have a mortgage, the amount you paid in taxes will be included on the same annual lender statement that shows your loan interest information. If you paid the property taxes yourself but don’t have receipts, you should be able to locate the total tax amount on your county assessor’s website.

Home Improvements

Making improvements on a home can help you reduce your taxes in a few possible ways:

- If using a home equity loan or other loan secured by a home to finance home improvements, these loans will qualify for the same mortgage interest deductions as the main mortgage. Only the interest associated with the first $100,000 is deductible (and if you’ve already maxed out the interest deduction on your main mortgage, you won’t be eligible for any additional deduction for this loan).

- Tracking home improvements can help when the time comes to sell. If a home sells for more than it was purchased for, that extra money is considered taxable income. However, you are allowed to add capital improvements to the cost/tax basis of your home thereby reducing the amount of taxable income from the sale. Keep in mind that most taxpayers are exempted from paying taxes on the first $250,000 (for single filers) and $500,000 (for joint filers) of gains.

- Home improvements made to accommodate a person with a disability (yourself, your spouse, or your dependents who live with you) may be deductible as medical expenses. Examples include adding ramps, widening doorways/hallways, installing handrails or grab bars, lowering kitchen cabinets, or other modifications to provide wheelchair access.

- If you live in Washington State and apply with your county prior to construction, you may be able to get a 3-year property tax exemption for major home improvements (including an ADU or DADU) that add up to 30% of the original home’s value.

Home Office Deduction

If you run a business out of your home, you can take a deduction for the room or space used exclusively for work as your principal place of business. This includes working from a garage, as well as a typical office space. Unlike most of the other deductible expenses, you can deduct home office expenses even if you opt to take the standard deduction.

This deduction can include expenses like mortgage interest, insurance, utilities, and repairs, and is calculated based on “the percentage of your home devoted to business use,” according to the IRS.

Home Energy Tax Credits

For homeowners looking to make their primary home a little greener, either the Energy Efficient Home Improvement Credit or the Residential Energy Clean Property Credit can help offset the cost of energy efficiency improvements. Even better, these are credits, which means they directly lower your tax bill.

- Energy Efficient Home Improvement Credit: 30% of the cost for qualified high-efficiency doors, window, insulation, air conditioners, water heaters, furnaces, heat pumps, etc. Maximum credit of $1,200 (heat pumps, biomass stoves and boilers have separate max of $2,000).

- Residential Clean Energy Credit: 30% of the cost for adding qualified solar/wind/geothermal power generation, solar water heaters, fuel cells, and battery storage.

What You Can’t Deduct:

- Mortgage Insurance (this is a change as of 2022)

- Title Insurance

- Closing Costs

- Loan Origination Points

- Down Payment

- Lost Earnest Money

- Homeowner’s Dues*

- Homeowner’s/Fire Insurance*

- Utilities*

- Depreciation*

- Domestic staff or services*

*Unless it’s related to your home-office deduction—contact your tax pro to see if it’s a qualified deduction for you.

Do you have a low-income, disabled or senior homeowner in your life? Check out this article on King County property tax relief.

Psst…every homeowner’s financial situation is different, so please consult with a tax professional regarding your individual tax liability.

Find a Home | Sell Your Home | Property Research

Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2024, Windermere Real Estate/Mercer Island.

Adapted from an article that originally appeared on the Windermere Blog, written by: Chad Basinger.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link