Waterfront Defined

Terminology

These local definitions will not only to help you know the lingo when it comes to waterfront speak, but to give you quick access tools to research waterfront to your heart’s content. Here is a quick resource to commonly used terms related to waterfront real property:

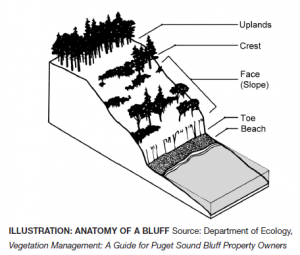

Bluff Most beaches on Puget Sound are backed by bluffs. These bluffs can vary from spectacular, high eroding cliffs to low, vegetated banks. The erosion of bluffs is a significant source of sediment on many Puget Sound beaches. One way of classifying bluffs is by the amount of sediment they provide to local beaches as they erode. This is based on how fast they erode, how high they are, and how much sand and gravel they contain. In these maps, bluffs are assigned to the following categories: Exceptional Feeder Bluffs; Feeder Bluffs; Feeder Bluff – talus; and Transport Zones. This Department of Ecology Feeder Bluffs and Coastal Landforms Map is a great tool for identifying bluff categories.

Boathouse A building designed for the storage of boats or watercraft to provide protection from the elements. The building of boathouses is generally prohibited under current environment regulations, but many grandfathered boathouses remain throughout the region.

Bulkhead A solid or open pile wall of rock, concrete, steel or timber or other materials or a combination of these materials erected generally parallel to and near the ordinary high water mark for the purpose of protecting adjacent wetlands and uplands from waves or currents.

Dock A raised walkway over water, often supported by widely spread pilings or pillars. Recent dock requirements encourage the use of decking structures and systems that encourage light and air flow to the water below. Also referred to as a pier.

Dock inspection A structural and functional evaluation by an individual or company who specializes in dock construction and repair. This can involve an underwater dive evaluation when portions of the supporting structure is in question or unobservable from above.

High bank waterfront Land that sits substantially above the natural water line, making the waterfront inaccessible without stairs or other structures, if at all.

Low bank waterfront Land that sits just above the natural water line, often delineated with a bulkhead protecting the shoreline. Low and no bank waterfront abutting a navigable lake is often considered the most desirable waterfront in the Puget Sound region.

Medium bank waterfront The most subjective of terms, this represents moderate bank land that is lower than high bank and higher than low bank waterfront.

Moorage A place where a boat or ship are secured in the water. As it pertains to waterfront real estate, this is typically on a privately owned dock or boathouse.

Navigable water “Navigability or navigable” means that a body of water is capable or susceptible of having been or being used for the transport of useful commerce. The state of Washington considers all bodies of water meandered by government surveyors as navigable unless otherwise declared by a court. See Who Owns the Water?

No bank waterfront Land that graduates out to the natural water line without a bulkhead separating it from the shoreline. Often described as rolling waterfront, its spacious feel at lakeside is highly desirable.

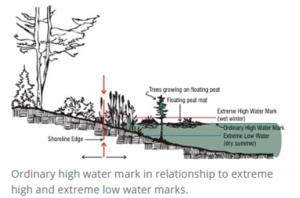

Ordinary High Water “Ordinary high water” means, for the purpose of asserting state ownership, the line of permanent upland vegetation along the shores of nontidal navigable waters. In the absence of vegetation, it is the line of mean high water.

Pier A raised walkway over water, often supported by widely spread pilings or pillars. Recent dock requirements encourage the use of decking structures and systems that encourage light and air flow to the water below. Also referred to as a dock.

Private Waterfront Land abutting the water owned exclusively by an individual land parcel. Greater waterfront footage and amenities (beach/dock/moorage) create a more valuable parcel than one with limited waterfront footage or amenities.

Shared Waterfront Land abutting the water owned in common (deeded) by owners of other often adjoining, land parcels. Fewer owner shares and deeded amenities (dock access/moorage) create a more valuable shared waterfront parcel than one with many owners or fewer amenities.

Shorelands Land which is alternately covered and left dry by the rising and falling of the water level of a lake, river, or tidal area.

“First class shorelands” means the shores of a navigable lake or river belonging to the state not subject to tidal flow, lying between the line of ordinary high water and the line of navigability, or the inner harbor line where established and within or in front of the corporate limits of any city, or within two miles thereof upon either side (RCW 79.105.060(3)). These boundary descriptions represent the general rule; however exceptions do exist. To determine if the shorelands are within two miles of the corporate limits of a city, the distance is measured along the shoreline from the intersection of the corporate limit with the shoreline.

“Second class shorelands” means the shores of a navigable lake or river belonging to the state, not subject to tidal flow, lying between the line of ordinary high water and the line of navigability, and more than two miles from the corporate limits of any city (RCW 79.105.060(17)). These boundary definitions represent the general rule; however, exceptions do exist. To determine if shorelands are more than two miles from the corporate limits of a city, the distance is measured along the shoreline from the intersection of the corporate limit with the shoreline.

(Public) Tidelands Land belonging to and held in public trust by the state for the citizens of the state, which are not devoted to or reserved for a particular use by law. Typically, the portion of land below the ordinary high water mark and the navigable water. Tide lines have been an area of great controversy in Washington State. Considered public domain through the Public Trust Doctrine. The Public Trust Doctrine does not allow the public to trespass over privately-owned uplands to access the tidelands. It does, however, protect public use of navigable water bodies below the ordinary high water mark.

“First class tidelands” means the shores of navigable tidal waters belonging to the state lying within or in front of the corporate limits of any city, or within one mile thereof upon either side and between the line of ordinary high tide and the inner harbor line; and within two miles of the corporate limits on either side and between the line of ordinary high tide and the line of extreme low tide (RCW 79.105.060(4)). In general, the line of ordinary high tide is the landward boundary. The line of extreme low tide, or the inner harbor line where established, is the waterward boundary. To determine if the tidelands are within two miles of the corporate limits of a city, the distance is measured along the shoreline from the intersection of the corporate limit with the shoreline.

“Second class tidelands” means the shores of navigable tidal waters belonging to the state, lying outside of and more than two miles from the corporate limits of any city and between the line of ordinary high tide and the line of extreme low tide (RCW 79.105.060(18)). In general, the line of ordinary high tide is the landward boundary. The line of extreme low tide is the waterward boundary. To determine if the tidelands are more than two miles from the corporate limits of a city, the distance is measured along the shoreline from the intersection of the corporate limit with the shoreline. Excerpt from the Department of Ecology Public Trust Doctrine.

Waterfront Footage The linear feet that span the water’s edge of a land parcel.

Watershed A watershed is the land area draining to a nearby river or lake, or sound.

Maps

There are many local map portals to assist in identifying topography, water conditions, hazards, and critical areas.

iMap Parcel Lookup Instructions (PDF)

Washington DNR Natural Hazards Geological Maps

Washington Geographic Information Portal Map

Department of Ecology Feeder Bluffs and Coastal Landforms Map

Department of Ecology Wetlands Inventory Map

NOAA Puget Sound Water Depth Chart

Resources

King County

King County currently has about 1200 documented residential docks and 58 private boat ramps (see shoreline land use facts). A permit is required to build, modify, alter the land abutting a shoreline.

King County Shoreline Management Fact Sheets and Links

King County Shoreline Permit Submittal Requirements (PDF)

King County Bulkhead Shoreline Requirements (PDF)

Shoreline Site Plan Requirements (PDF)

King County Shoreline Property Owner Resources

King County Lake Services and Information

Puget Sound Shoreline Stewardship Guidebook

King County Water and Shorelines Glossary

Washington State

Washington State (RCW) Aquatic Land legal definitions

DFW – Your Marine Waterfront (PDF)

DNR – Puget Sound and Coastal Geology

DNR – Puget Lowland Geological Province

Dept of Ecology – Mapping Bluffs and Beaches of Puget Sound (PDF)

WSU Guide for Shoreline Living (PDF)

UW Puget Sound Fact Book (PDF)

Environmental Protection Agency

Shoreline and Wetland Tools and Resources

King County watershed overview map

Cedar River – Lake Washington Watershed (Lake Washington waterfront properties)

Central Puget Sound Watershed (North/West Seattle waterfront on Puget Sound)

Green-Duwamish River Watershed (South Seattle waterfront properties on Puget Sound)

Sammamish Watershed (Lake Sammamish waterfront properties)

National Oceanic and Atmospheric Administration

ERMA visualization map of Puget Sound

Bluffs, landforms and habitat classifications

The Watershed Company (site evaluation contractor) Articles

A home buyer’s guide to property with critical areas

Shoreline planning and permitting

We hope this provides an outstanding starting point in your waterfront journey. In addition to this specific research, don’t forget to evaluate all the typical aspects of your potential new home and neighborhood. We’ve compiled links to research tools from schools and geological hazards to market reports and census data.

While you’re there, you can also look up neighborhood info, including crime reporting, local government resources, parks and recreation, and school boundaries.

Of course, nothing tops having an experienced broker to guide you through the process. They’ve seen hundreds upon hundreds of homes and can help you identify the solid finds from the duds with gorgeous looking veneer.

Choosing the right broker can save you thousands on your home purchase. Whether through local market knowledge and pricing analysis allowing you to make a smarter offer, recommendations and resources to thoroughly conduct your due diligence and avoid costly mistakes, or savvy contract negotiation to help you get the terms you need, having a Windermere broker on your side is one advantage you can’t afford to sacrifice.

Find a Home | Sell Your Home | Property Research | Neighborhoods | Market Reports | Our Team

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2020 Windermere Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link